Nepal Tourism Update – September 2025: Trends, Market Insights, and What’s Next for Visit Nepal

Data-driven brief for the travel trade and travelers alike—crafted by Travelling Nepal.

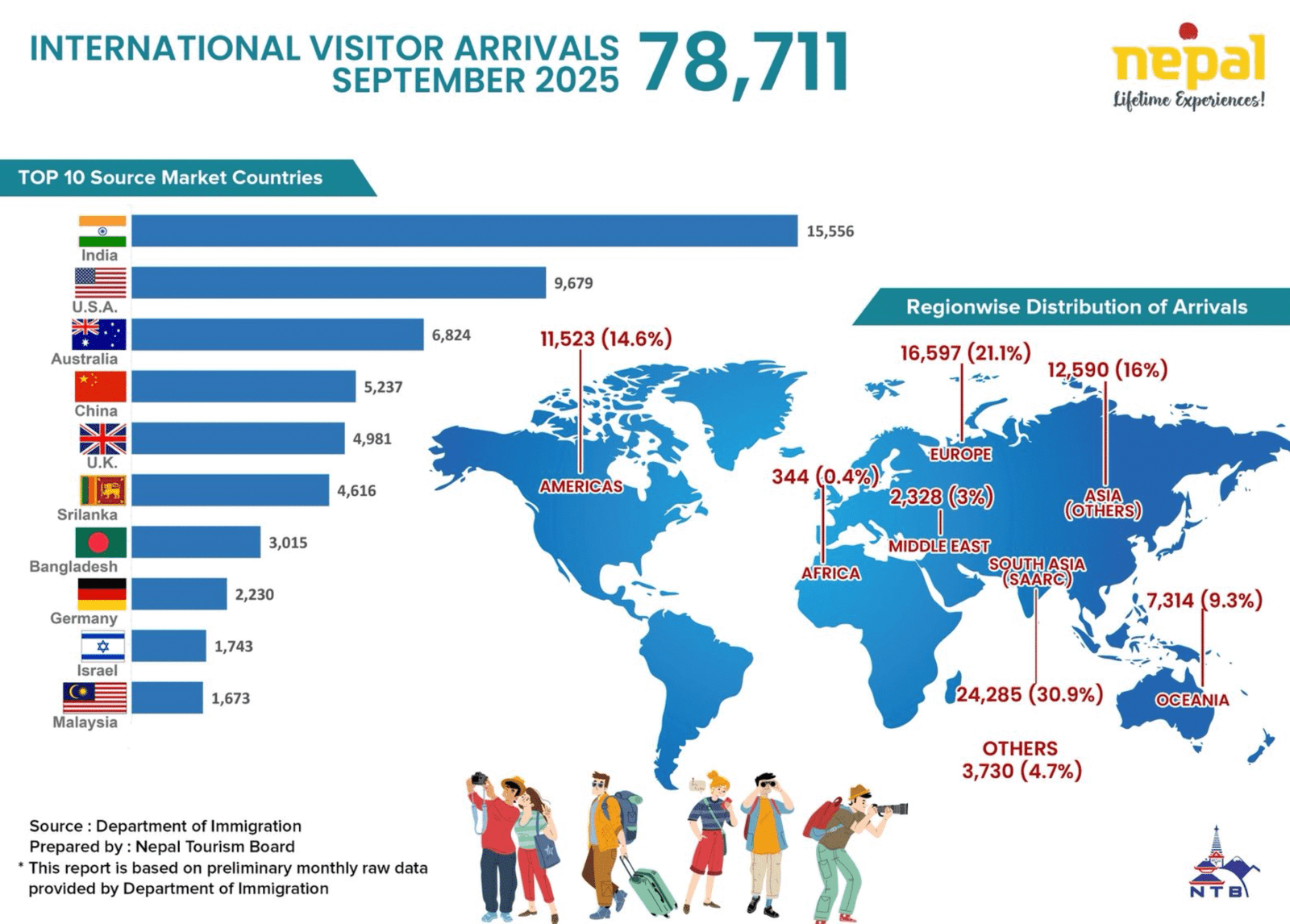

Nepal closed September 2025 with 78,711 international visitor arrivals (IVAs)—a result that sits 18.3% below September 2024 but still reflects an 85% recovery versus the same month in 2019. The country’s post-pandemic normalization is evident: a softer month year-on-year but a steady return toward pre-2020 baselines. Year to date, January–September 2025 totaled 815,273 arrivals, laying a pragmatic base ahead of the peak autumn trekking period and the run-up to Visit Nepal 2026. Positioned at the crossroads of South Asia, Nepal continues to refine its value proposition—world-class trekking, living heritage, and growing sustainability credentials—while competing for share in a price- and schedule-sensitive global market.

Nepal’s Tourism Recovery Overview

YoY softness (−18.3%) with identifiable headwinds

- Late-monsoon weather pulses disrupted a portion of domestic flights and ground transfers, dampening last-minute bookings.

- Global macro caution (airfare sensitivity, currency dynamics) weighed on long-haul discretionary travel.

- Schedule volatility on select routes made buffer days and flexible policies more decisive in trip planning.

Structural recovery: 85% of September 2019

Against a longer view, the 85% recovery vs. 2019 signals a durable rebound. Proximity markets led the way, while long-haul segments—especially those reliant on premium air capacity—are normalizing more gradually.

Jan–Sept momentum: 815,273 arrivals

With 815k visitors in the first nine months, Nepal enters Q4 with a foundation that can still deliver a strong year, contingent on aviation capacity, stable weather, and timely communications during the October–November peak.

Top International Markets

Top 5 source markets (September 2025):

- 🇮🇳 India — 15,556 (19.8%)

- 🇺🇸 USA — 9,679 (12.3%)

- 🇦🇺 Australia — 6,824 (8.7%)

- 🇨🇳 China — 5,237 (6.7%)

- 🇬🇧 UK — 4,981 (6.3%)

What the market mix tells us

- India remains the anchor at nearly 1 in 5 arrivals. Proximity, price-competitiveness, pilgrimage/VFR segments, and flexible leave patterns sustain demand even when global headwinds rise.

- USA holds a stable double-digit share. Interest in adventure tourism in Nepal (trekking/expeditions) and heritage circuits remains robust, though airfare spikes can suppress late-booking conversions.

- Australia consistently punches above weight thanks to outdoors culture and shoulder-season flexibility—good news for lodge and DMC yield.

- China is rebuilding at 6.7%, below historical highs. Recovery pace hinges on seat capacity, outbound policy, and campaign alignment into 2026.

- UK provides a resilient premium mix—longer trips and guided trekking favored—supporting higher per-visitor spend.

Regional Breakdown Insights

Regional composition of September IVAs:

- South Asia (SAARC): 24,285 (30.9%)

- Europe: 16,597 (21.1%)

- Asia (Other): 12,590 (16.0%)

- Americas: 11,523 (14.6%)

- Oceania: 7,314 (9.3%)

- Middle East: 2,328 (3.0%)

- Africa: 344 (0.4%)

- Others: 3,730 (4.17%)

Interpretation

- SAARC leads—proximity markets recover first and maintain steady flows even during weather noise; India is the main engine, with Sri Lanka/Bangladesh contributing seasonal bumps.

- Europe aligns with autumn trekking (Sept–Nov): longer trips, culture add-ons (Pokhara/Chitwan), and school-leave calendars.

- Asia (Other) reflects price-sensitive, promotions-driven demand—quick to respond to airfare deals and holiday peaks.

- Americas are value-rich: longer stays and multi-product itineraries (trek + culture + wildlife).

- Oceania continues rising; flexible work-leave and high appetite for high altitude trekking Nepal sustain its near-10% share.

- Middle East and Africa remain small but strategic for VFR, pilgrimage, and stopover-enabled itineraries via Gulf hubs.

Tourism Industry Impact & Stakeholder Response

Airlines & access

Autumn is yield-critical. Any air capacity squeeze or fare inflation can curb late-booking momentum in long-haul markets. Conversely, tactical sales on Gulf/South Asia connectors lift SAARC and Asia shares quickly. Clear IRROPS playbooks (weather diversions, Lukla/Manthali timing) help OTAs and operators maintain credible buffer days.

Trekking & product mix

Demand concentrates on Everest Base Camp, Annapurna Circuit, Manaslu Circuit, Langtang Valley, Upper Mustang. Climbing interest is gradually returning; incentives for lesser-known peaks and sustainable trekking Nepal messaging can spread traffic beyond the most crowded corridors.

Accommodation & local services

City hotels packaged value adds (transfers, late checkout, heritage walks) to cushion softer shoulder nights. In the hills, teahouse occupancy tracked weather/flight reliability; late-monsoon disturbances added friction to walk-in flows.

“When the news cycle turns negative, phones go quiet for a week,” says one Kathmandu-based operator. “But trekkers are resilient. If updates on route status are transparent and airfares hold steady, the core autumn season still performs.”

Behavior shifts

- Shorter average stays paired with more intensive experiences (trek + one cultural city).

- Higher pre-payment online and ongoing demand for flexible cancellation.

- Growing preference for eco-lodges, filtered-water availability, and porter welfare—now standard RFP items for group organizers.

Forecast for October–December 2025

Q4 expectations

- Oct–Nov remain the strongest trekking window. With 815k YTD, Nepal can still approach a solid year-end if aviation, weather, and communications align.

- Demand drivers: pent-up trekking interest, EU/Oceania breaks, and targeted adventure campaigns.

- Risks: late-season weather, airfare spikes, or policy noise that deters late bookers.

Visit Nepal 2026: momentum building

- Sharpen product pillars: trekking, culture, wellness, wildlife.

- Advance digital permits, eco-lodge standards, and live trail-status dashboards for EBC/Annapurna/Manaslu/Langtang/Upper Mustang.

- Use booking-window campaigns (Jan–Mar, Aug–Sep) in partnership with airlines and DMCs.

2026 baseline outlook

If Q4 tracks seasonal norms, 2025 should finish close to full recovery—setting up measured growth for 2026. Proximity markets will remain the bedrock; North America/Oceania will drive higher-yield segments; and China is the wild card pending seat injections and outbound policy signals.

What the Numbers Mean for Key Stakeholders

For the Nepal Tourism Board & public sector

- Publish monthly dashboards (market/region) with a dedicated route & weather advisory hub each autumn.

- Embed Visit Nepal 2026 CTAs: “Where to trek in March/April,” “Family-friendly week in Pokhara,” “Langtang by bus—no domestic flight.”

For airlines & airports

- Lock shoulder-season promos 4–6 weeks out; co-market with NTB and route-specific content.

- Offer transparent IRROPS policies to preserve traveler confidence and tour integrity.

For trekking companies

- Diversify beyond EBC/ABC—spotlight Manaslu Circuit, Langtang Valley, Upper Mustang for misaligned calendars.

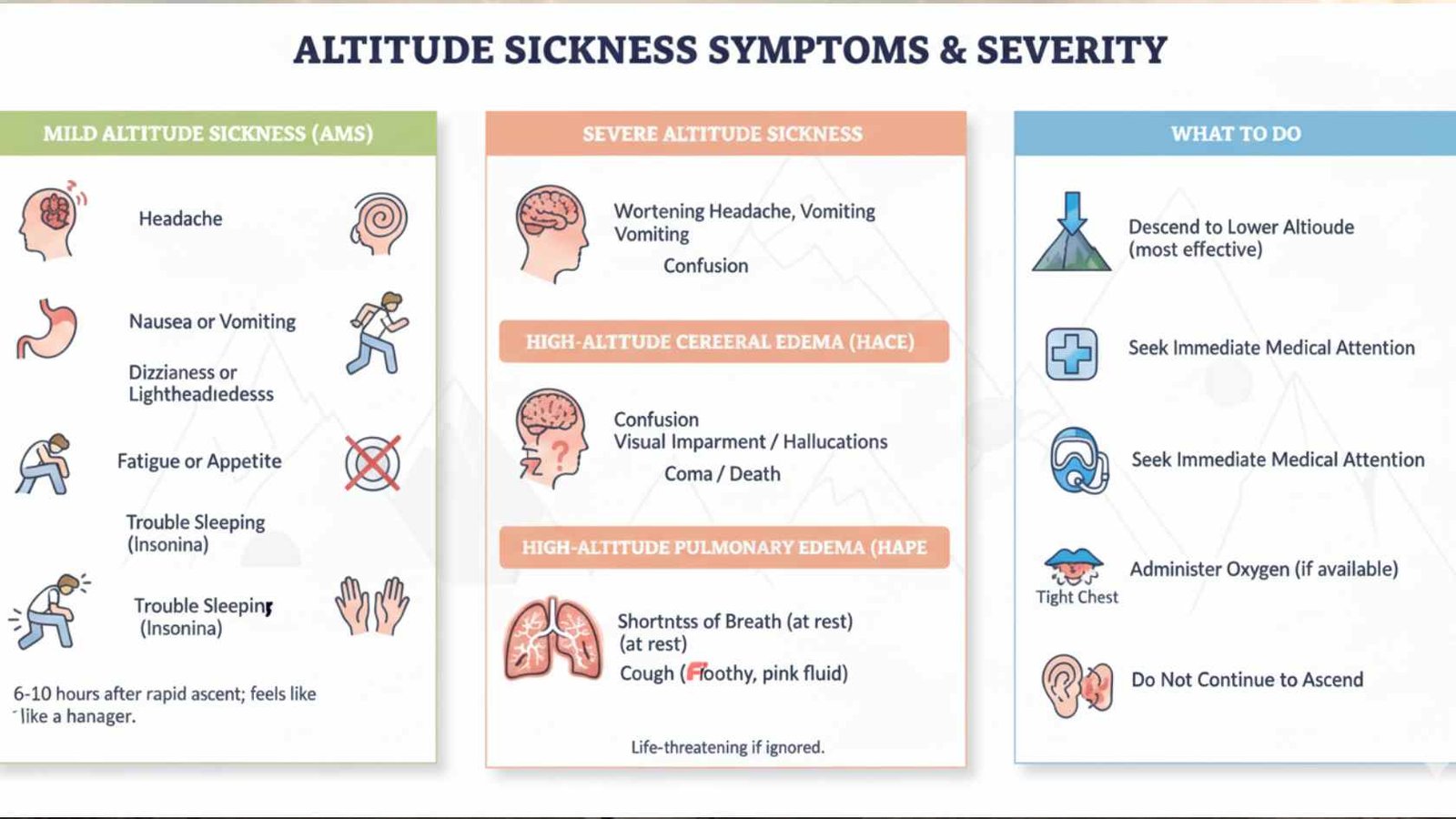

- Post daily route notes, teahouse availability, and acclimatization reminders across channels.

For hotels & local businesses

- Bundle “48 hours in Kathmandu” (museums, heritage walks, culinary trails) to lift ASP.

- Communicate sustainability wins (filtered water, plastic reduction, porter welfare). These influence purchase decisions in US/EU/AU cohorts.

Market-by-Market Watchlist

- India (19.8%): Lean into religious circuits, weekenders, and festival travel; family-friendly soft-adventure intros.

- USA (12.3%): Emphasize value-per-day vs. other regions; clarity on insurance/evac coverage; highlight responsible travel credentials.

- Australia (8.7%): Promote shoulder windows and jeep-assisted itineraries (e.g., Annapurna balcony trails).

- China (6.7%): Prepare scalable, modular products for seat injections (short EBC loops; Pokhara + Lower Mustang culture routes).

- UK (6.3%): Strengthen club/association partnerships; guided small-group treks mixing culture + comfort.

Risks & Wildcards

- Weather & infrastructure: Late-season rain/landslides can disrupt air/road links; real-time advisories reduce cancellations.

- Policy/price shocks: Shifts in climbing fees, visas, or permits can rapidly alter sentiment and market mix.

- Global macro: Airfare inflation and currency volatility affect long-haul elasticity.

Action Checklist for Visit Nepal 2026

Messaging

- Lead with “Trekking + Culture in 7–10 days” for time-poor markets.

- Promote winter sun + wellness and rain-shadow treks as shoulder-season storylines.

Product

- Scale eco-lodges and refill stations; badge on official maps.

- Invest in digital permits and live trail dashboards to support route planning and safety.

Trade

- Coordinate airline–NTB campaigns to booking windows (Jan–Mar, Aug–Sep).

- Provide sustainability toolkits to DMCs (porter welfare, plastic reduction, carbon accounting).

Bottom line: September 2025 was a mixed month—down year-on-year, yet solid against 2019 and backed by an 815k YTD base. With autumn peaks underway, the pieces are in place for a steady close to 2025 and a confident launch into Visit Nepal 2026. For travelers and the trade, the direction is clear: the Nepal tourism recovery is consolidating around quality experiences, clear information, and sustainable growth. Explore Nepal’s majestic Himalayas, heritage, and hospitality—now more accessible than ever.

Suggested Links on Travelling Nepal

- Trekking in Nepal 2026/2027 – Complete Guide

- High-Altitude Trekking in Nepal

- Manaslu vs Everest vs Annapurna: Trekking Comparison

- Annapurna Circuit 12-Day Itinerary (2026)

Ref:https://trade.ntb.gov.np/

Post Comment